Filing for bankruptcy can frequently be a stopgap, an opportunity to reorganize business operations and proceed. When a restaurant or retailer files for Chapter 11 bankruptcy protection, closing some underperforming outlets is typically a part of the process.

That’s usually a good thing because most restaurants and shops have a few places where it’s no longer profitable. For instance, the COVID-19 outbreak led several businesses to provide hybrid work schedules or permit employees to work from home.

As a result, certain chains of restaurants and businesses discovered that their sites were no longer receiving enough business. People just stopped going to some places in sufficient quantities to warrant keeping the stores open.

Due to demographic changes, even a thriving chain like Starbucks closes dozens of locations annually. In these cases, the corporation either keeps the stores open until the leases expire or closes the locations and pays off the lease.

A struggling restaurant business or retailer can close sites and, in some situations, escape their lease commitments by declaring bankruptcy.

On the Border wants out of its leases

On the Border shut down around 80 locations immediately after declaring Chapter 11 bankruptcy on March 5. The Chapter 11 filing in the U.S. Bankruptcy Court for the Northern District of Georgia states that this amounts to nearly two-thirds of its stores.

On the Border is seeking to terminate its lease.

A “significant number” of the company’s 113 restaurant location leases as of the March 5 filing are for non-operating locations, the company stated. As of the petition date, the corporation wishes “to reject the leases for non-operational restaurants,” according to the statement.

The document identified a major cause of the business’s financial difficulties.

The company reported that it spent around $25.3 million in 2024 on lease commitments, of which about $11.9 million was related to failing locations. “Given the company’s operational headwinds and financial position, payment of lease obligations associated with nonperforming leases has caused significant strains on the company’s liquidity,” it stated.

In other words On the Border has been losing money on leases that cost more than many of its locations bring in. The company has been taking steps to cut costs, a process that started before its Chapter 11 bankruptcy filing.

“The debtors have already begun to reduce their cost structure without compromising quality by rationalizing the debtors’ restaurant footprint,” stated the petition. “On or recently before February 24, 2025, the debtors made the difficult decision or were otherwise required to close and vacate 40 stores.”

The forty locations were “deemed to be nonperforming because of rent costs and/or financial performance, such that operating those stores was deemed to be financially burdensome to the rest of the company.”

On the Border has requested that the court absolve it of its lease obligations at its shuttered locations.

On the Border hopes to survive

For a possible marketing process to sell assets on a going-concern basis or to finalize another strategic value-maximizing deal that would address the company’s operational and financial issues, On the Border hired Hilco Corporate Finance in January.

The corporation wants to find an operator who will maintain the On the Border brand, which is a clever legal way of expressing that.

“At the debtors’ direction, Hilco approached interested parties to secure a stalking horse bidder for the sale of the Debtors’ assets under Section 363 of the Bankruptcy Code,” the bankruptcy filing stated.

“In total, during the sale process, Hilco contacted 273 strategic and financial potential bidders to serve as a potential stalking horse bidder, of which 31 ultimately negotiated confidentiality agreements and were provided a confidential information memorandum.”

Although the company has not yet signed a stalking horse bid agreement, it plans to reveal one “in the coming days.” It is anticipated to be OTB Lender LLC, Pappas Restaurants’ affiliate, which has lent the business $10 million in a debtor-in-possession arrangement.

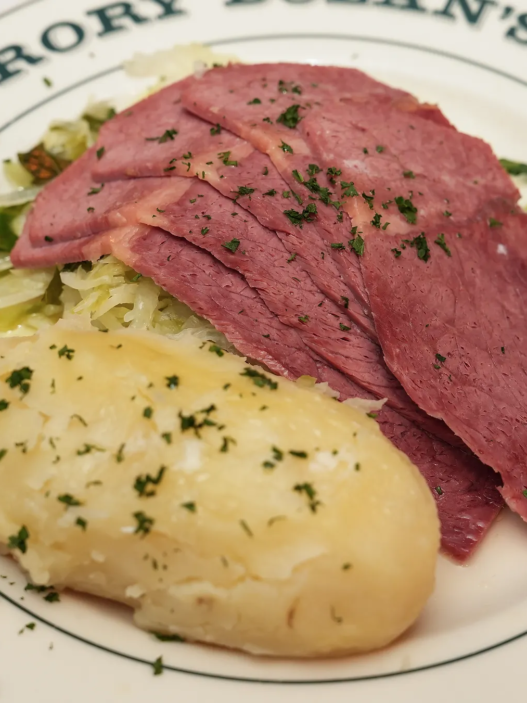

“On The Border was established in 1982 and is well-known for its award-winning margaritas, house-made salsa, sizzling mesquite-grilled fajitas, and a limitless supply of chips and salsa. According to the company website, “it’s a favorite destination for fresh Tex-Mex food and vibrant good times,” with 80 restaurants in the United States and abroad.